The CEO of the new Bed Bath & Beyond said the rebirth of the home specialty retail brand under the former Overstock operation is enjoying early success as the company blends customer bases and repositions operations and marketing to take advantage of immediate opportunities while implementing a long-term strategy.

For now, key parties of interest seem to fall between satisfied and enthusiastic, said Jonathan Johnson, CEO of the new Bed Bath & Beyond, told HomePage News. Johnson (pictured above) said the company has positioned itself to build off strengths provided by the legacy Overstock and Bed Bath & Beyond businesses as now combined, which will have a range of consequences.

Already, the new Bed Bath & Beyond has had the opportunity to test new approaches to seasonal promotion for Labor Day with an eye toward the forthcoming holiday season. Meanwhile, it is applying expertise and advantages offered by the two legacy companies, including strength in website and fulfillment functions; and expertise in registry operations across the reconstituted company.

Overstock in June turned in the winning bid of $21.5 million for the Bed Bath & Beyond intellectual property.

Johnson said consumer response to the changeover to Bed Bath & Beyond had been positive across its North American markets. Overstock reintroduced the Bed Bath & Beyond banner to Canada several weeks before its August revival in the United States.

“Customers in Canada have given a very positive response,” Johnson said. “The U.S., similar, a little slower, in part because it’s much bigger and our ability to send emails to the entire customer base of the old Bed Bath & Beyond takes time. We don’t want to overwhelm the email pipes because we then get caught in spam houses. Thus far, what we’re spending on performance marketing has been well spent, and customers are buying.”

Customers are key, Johnson said, but other audiences of interest are important to Bed Bath & Beyond’s success.

Customers in Canada have given a very positive response. The U.S. is similar, a little slower, in part because it’s much bigger and our ability to send emails to the entire customer base of the old Bed Bath & Beyond takes time. We don’t want to overwhelm the email pipes because we then get caught in spam houses. Thus far, what we’re spending on performance marketing has been well spent, and customers are buying.

– Jonathan Johnson, CEO, Bed Bath & Beyond

Customers are key, Johnson said, but other audiences of interest are important to Bed Bath & Beyond’s success.

“What’s very encouraging to us, and I think it’s the best early indicator, is the reaction from suppliers,” he said. “There are suppliers we have been courting and really wanting to do business with for a long time as Overstock that wouldn’t do business with us or would only open just a portion of their catalog to us. Now it’s going the other way. They’re coming to us, and they’re wanting to do business, and they’re wanting to give us their entire catalog. So, our SKU count is way up, product offering is much improved.”

Johnson is set to present to an audience of top-level housewares supplier executives during the International Housewares Association’s forthcoming Chief Housewares Executive SuperSession (CHESS), October 3-4 in Rosemont, IL.

Another critical constituency that has bought into the change is the company’s workforce, which appreciates the value of the Bed Bath & Beyond name and recognizes it as a new corporate moniker that is immediately familiar and won’t take a huge investment to build in the consumer consciousness, Johnson said.

“For years, our employees have asked me, ‘Jonathan, when are we going to change our name? We’re not a liquidator.’” He said. “The enthusiasm among the employee base to be with a name everyone knows and their neighbors are talking about. Or their relatives are calling them saying, ‘You guys did what? That’s brilliant.’ The employees really love this. So that reaction’s been good.”

Another vital constituent group includes Wall Street and investors.

“I think the reaction there has been good,” Johnson said. “There has been a little pullback in the market recently, but we’re still in a much better place than we were, much higher value than we were then when we first announced this deal.”

The purchase of Bed Bath & Beyond’s intellectual properties and the change in the corporate identity from Overstock have garnered a great deal of attention over the past couple of months. However, it’s relevant to consider that Overstock had already been in a transitional process over the past couple of years, moving out of a number of product categories to focus on home furnishings and housewares.

When Johnson joined the company 21 years ago, Overstock still was a product liquidator. It wasn’t long after that the company began evolving into a general merchandise e-tailer selling everything from books and music to jewelry and clothing. It continued along those lines earlier until earlier this decade when leadership decided that the company would focus operations on home furnishings and furniture. However, the initiative was burdened by a particular challenge.

“A year and a half ago, we became 100% home and our effort was to associate the fairly well-known Overstock name with home,” Johnson said. “But that was just hard. Overstock has a generic meaning: It’s synonymous with liquidation. And so, we’ve been looking at other names. We’ve long liked Bed Bath & Beyond. We liked its name. We liked its customer base, its customer demographic. So when this opportunity came up in bankruptcy, it felt like, wow, we now have a chance to rebrand not to a new name that will take years and hundreds of millions of dollars to associate with us and with home but to buy a well-trusted iconic brand and just do the switch there.”

The task at hand now, he said, is to make sure legacy Overstock and Bed Bath & Beyond understand what this combined operation is about.

“Early days, but so far so good,” Johnson said. “Legacy Overstock customers are shopping at the Bed Bath & Beyond site, and legacy Bed Bath & Beyond customers are shopping at our Bed Bath & Beyond site.”

A year and a half ago, we became 100% home and our effort was to associate the fairly well-known Overstock name with home. But that was just hard. Overstock has a generic meaning: It’s synonymous with liquidation. And so, we’ve been looking at other names. We’ve long liked Bed Bath & Beyond. We liked its name. We liked its customer base, its customer demographic. So when this opportunity came up in bankruptcy, it felt like, wow, we now have a chance to rebrand not to a new name that will take years and hundreds of millions of dollars to associate with us and with home but to buy a well-trusted iconic brand and just do the switch there.”

– Jonathan Johnson, CEO, Bed Bath & Beyond

Due Diligence

Johnson said the company did brand and customer demographic research even before Bed Bath & Beyond wound up in court in anticipation of its going into bankruptcy. The research, he added, demonstrated the Bed Bath & Beyond brand still had value despite the company’s financial woes. Another topic of research was the behavioral demographic of the legacy Overstock customer as compared to the primary Bed Bath & Beyond shopper.

“We think behavior demographics are much more relevant than age, income, education, these kinds of demographics because you can make a lot of money or a little money and still behave differently than others in your economic band,” Johnson said. “The behavioral demographic is legacy Overstock customers and legacy Bed Bath & Beyond customer-like deals. Both of us have been high/low retailers. We have promotions and coupons. Everyone knows the big blue (former Bed Bath & Beyond) coupon. What they look for in their homes is very much the same. We think how we market the new Bed Bath & Beyond will resonate and make sense with the legacy Overstock customer and with the legacy Bed Bath & Beyond customer. Both will feel very comfortable at our new site.”

The price consciousness of consumers who shopped both Overstock and Bed Bath & Beyond before the intellectual property sale is such that it could provide the new business with an advantage.

“We’ve always been about smart value and I think that’s what Bed Bath customers would like,” Johnson. “I think legacy Bed Bath customers will find the value we offer, even with maybe a smaller coupon, is better than what they would have found at the old Bed Bath & Beyond. Our pricing is sharper.”

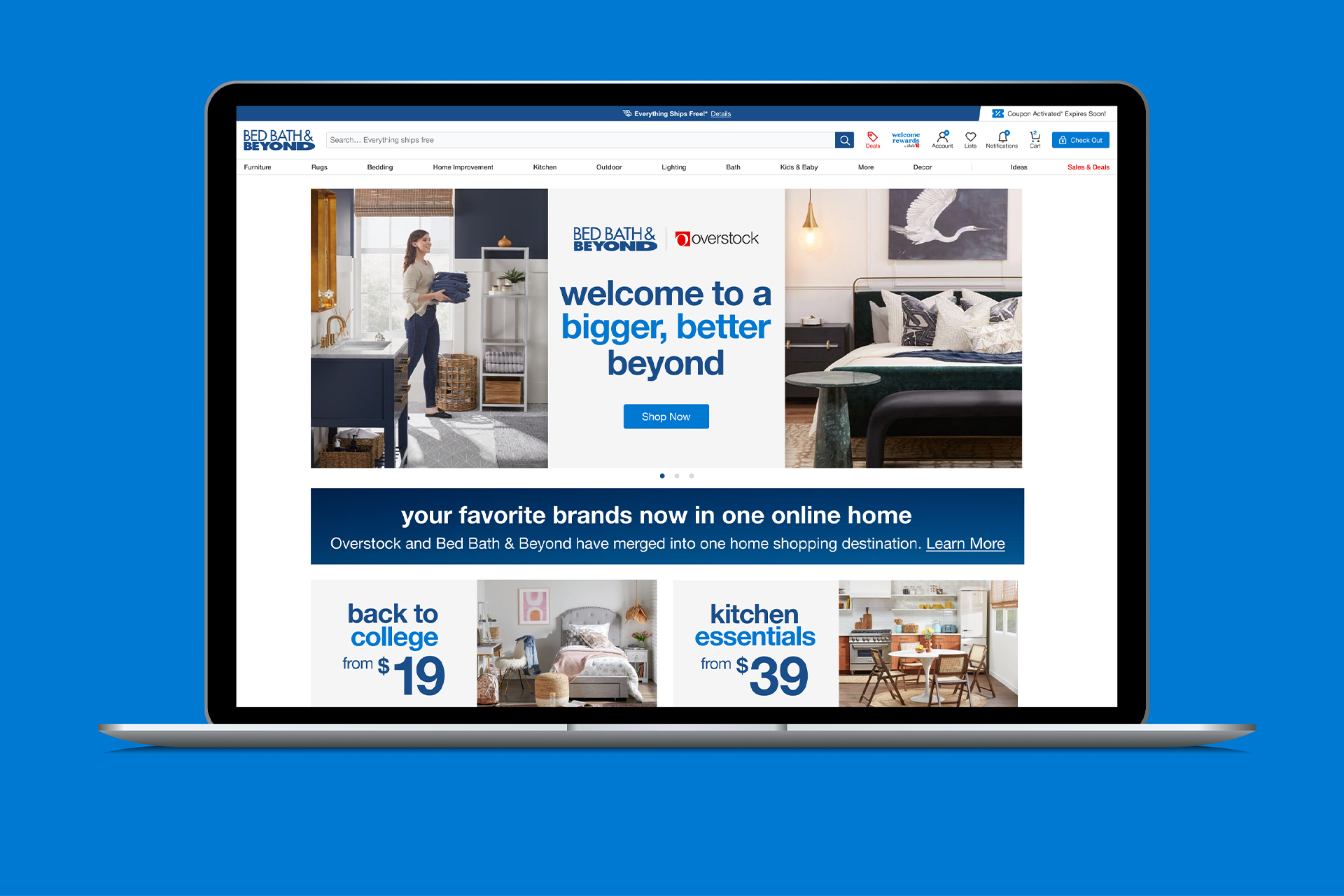

Punching in either the old Overstock or Bed Bath & Beyond web addresses will bring shoppers to the reconstituted Bed Bath & Beyond site. For continuity’s sake, the site continues to include an Overstock logo alongside a Bed Bath & Beyond graphic that not only signals the change but also clicks through to an explanation.

“We anticipate and plan to sunset that logo over time and lose the Overstock identity and become wholly Bed Bath & Beyond,” Johnson said.

Since the site launch in July, the new Bed Bath & Beyond has reported increased website visits and conversions along with strong engagements within the historic customer base.

New BedBathandBeyond.com

At the same time, by employing Overstock’s low-inventory business model to support the Bed Bath & Beyond operations, the company can expand the product assortment without having to assume more warehousing cost. In those circumstances, Bed Bath & Beyond now has a chance to help consumers explore the product choices it provides in a more satisfying way, Johnson said. Because the former Bed Bath & Beyond leadership grudgingly entered the e-commerce realm, Bed Bath & Beyond never really got comfortable there, and by the time the company really understood that it needed to make a commitment and establish a position in the market, it was far behind its competition. Moreover, because the former Bed Bath & Beyond organization simultaneously was trying to make major changes in stores and assortment during its final years before liquidation, the e-commerce part of the business never distinguished itself versus the competition. With the change in ownership of the Bed Bath & Beyond intellectual property to Overstock, the new Bed Bath & Beyond operation had an opportunity to shed weaknesses that held back both of its antecedents.

“We thought, Overstock’s got this great business model that knows how to make money,” Johnson said. “It provides good/better/best products in each category that had been weighed down by a boat anchor of a name. I really think it’s been a huge drag on us. Bed Bath has this iconic name but over time it was weighed down by what had become a boat anchor of a business model, whether it was the stores, the heavy debt or the digital website not running as well. So, what I think we’ve done here is we’ve taken the two good pieces of each organization and we’ve rid ourselves of the boat’s anchor pieces.”

The new Bed Bath & Beyond will continue to offer a good/better/best assortment to allow customers to find suitable price points across income demographics. Already, the company is fulfilling a day or more faster than the former Bed Bath & Beyond did previously.

Fulfillment is a critical component of digital operations, but one that’s relative to the particular product categories a retailer carries. Today’s Bed Bath & Beyond doesn’t emphasize everyday needs that would necessitate overnight shipping. So, ultimately, fulfillment becomes a question of balance.

“Our business model is we have drop shippers,” Johnson said. “There are certain products that people expect this afternoon or at the latest tomorrow. There are other products that people don’t expect or want them to show up this afternoon. If you’re ordering patio furniture, and you order Tuesday and it’s going to come next Monday that’s fast enough. You actually prefer it to be there on Monday rather than a day late on Tuesday or even a day earlier on a day of the week when you’re not ready for it. And so, we stay in a space where accuracy of delivery estimate is important. Now, if you’re ordering patio furniture and it’s not going to be there for four weeks, we lose.

“So it’s got to be fast enough but within that fast enough band what’s really important is the accuracy of our estimate, and we can know that because you’re in New York and it’s being shipped from Atlanta and we can factor it in,” Johnson continued. “We know, for each product to each zip code, how long it should take.”

“We thought, Overstock’s got this great business model that knows how to make money. It provides good/better/best products in each category that had been weighed down by a boat anchor of a name. I really think it’s been a huge drag on us. Bed Bath has this iconic name but over time it was weighed down by what had become a boat anchor of a business model, whether it was the stores, the heavy debt or the digital website not running as well. So, what I think we’ve done here is we’ve taken the two good pieces of each organization and we’ve rid ourselves of the boat’s anchor pieces.

– Jonathan Johnson, CEO, Bed Bath & Beyond

Bed Bath & Beyond, even in its online function, was always tied to the store base, in part because the prime promotional vehicle was the mailed coupons. In its original manifestation, Bed Bath & Beyond was a suburban retailer. The company had urban and rural stores but the concept was most at home in the ‘burbs. With the new business model and freedom from a store base, the new Bed Bath & Beyond may have an in expanding the customer base where the predecessor operation may not have managed as well.

“Part of the beauty of being online is our store is everywhere,” Johnson said. “It’s on your mobile app when you’re taking the subway in New York City, and it’s on your desktop when you’re shopping from a thousand-population town in rural Wyoming. The name is well known enough beyond the suburbs, in exurbs and rural and urban areas. We think that, by spending the right amount of marketing and having it being more of a presence on the Internet, particularly as our category continues to migrate from brick and mortar to online, there’s a real chance to expand that customer base beyond the suburban customer to either urban or rural.”

Another way Bed Bath & Beyond as constituted today can expand its draw to customers is by effectively offering a wider variety of products. The former Bed Bath & Beyond expanded its furniture offering a few years ago as it sought to reposition the business but never fully realized its ambition. Overstock was an established furniture e-tailer. As such, the company today is more broadly positioned throughout the home goods space.

“When you have a storefront and you’re in New York City, you stock it for the bulk of the New York City customers,” Johnson said. “If you have a storefront in a rural place, it probably has a little bit of different inventory. We have the same, much broader inventory for everyone. So if you’re in New York and you don’t necessarily like what your neighbors like, you’re still going to find it on the new Bed Bath & Beyond website. And if you’re out in the country and you want something that feels more urban, you’ll find that on the Bed Bath & Beyond website. So, I think we can really talk to a much broader customer base and offer more depth of product to purchase.”

In terms of consumer outreach for a web-based retailer, the Overstock history applied to the Bed Bath & Beyond operation will allow application of capabilities and experience that should provide additional advantages.

“We’re relatively good at it, but we’re getting better,” Johnson said. “When you have an endless aisle that you can have online but you can’t have brick and mortar, you need to be really good at two things: You need to be good at internal search, so that when people come directly to the site and type in 800 thread count Egyptian cotton sheets, king size, what they are served up is 800 thread count Egyptian cotton sheets, king size. So that internal search is something we’ve worked to improve.

“The other thing is personalization,” he continued. “I think that comes through our mobile app and the personalization that we serve up on the website. With both of those, we’re able to know what you shop for and what you like and feed those in to keep things closer to you, so that the endless aisle, where we cut the end off, is for things that aren’t your style.”

Registry Evolution

The new Bed Bath & Beyond is building up its registry operations for significant life events.

“We know that we’ve not been good at this because we were self-aware enough to know that it didn’t make sense under the Overstock brand,” Johnson said. “Not even my children would put on their wedding invitations registered at Overstock.com. The connotation of the name is not something you want on that life event. But people frequently registered at Bed Bath & Beyond, whether that’s for babies or weddings or even graduations. We think that we can do a lot more personalization there to make the site more meaningful,” Johnson said.

The new Bed Bath & Beyond operation also gets a boost from Overstock’s knowledge of digital marketing.

“We have partnerships with some brand ambassadors,” Johnson said. “We continue to use influencers. I think you will see us grow into TikTok. We’ve kind of been slow to that game. We know that with this brand, it’s worth spending on. What we were realizing was, spending on the Overstock brand was a little like spitting into the wind. Mostly it just came back at us without the return on investment we were hoping for. Spending into the Bed Bath & Beyond brand, we think we’ll have a much better return on investment than we had been getting, return on ad spend than we’ve been getting.”

As to the possibility for the return of Bed Bath & Beyond physical stores, Johnson said nothing is on the horizon As he has put it in discussing a brick-and-mortar possibility: “Never for now.”

For the holidays, Johnson said, opportunities to drive the business will be important.

As Overstock became a general merchandiser, the company advanced at creating special events for holiday occasions. It would launch major promotions for such holiday periods as Black Friday weekend or Memorial Day.

“The fourth quarter, as we focused on home, particularly as our home was more beyond than bed bath, we got less seasonal,” Johnson said. “This lets us go back to our roots and get much more seasonal. Whether it’s kitchenware, small appliances, seasonal cushions, we can go back to our roots and really offer great deals.”

This past Labor Day presented the new Bed Bath & Beyond the opportunity to explore seasonal promotions. As it evaluates results, the company will be able to adapt learnings to its plans for the last half of the year.

“Labor Day historically is a big furniture time,” Johnson said. He reported the new site succeeded during the Labor Day weekend in attracting customers to the bedding, bath and kitchen categories, noting such categories recorded strong growth year-over-year in aggregate.

“Many of the new SKUs that we’ve added are in what I would call giftable categories,” Johnson said. “They’re more bed, they’re more kitchen, they’re more bath. Not very many people are giving dining room sets for Christmas. Lots of people are giving a Dyson vacuum or a Keurig coffee maker. We’ll be deeper in those areas than we’ve been in the past.”