The National Retail Federation said today that retail sales continued to push forward in September even as consumers faced continuing economic pressures.

NRF’s calculation of retail sales – based on Census Bureau figures but excluding automobile dealer, gasoline station and restaurant results to focus on core retail – had September up 0.5% seasonally adjusted from August and 2.2% unadjusted year over year. In August, sales were up 0.2% month over month and 3.6% year over year.

On a three-month moving average, NRF’s numbers were up 3.1% unadjusted year-over-year as of September and 3.7% for the first nine months of the year.

As to sales by channel, according to NRF:

- General merchandise stores were up 0.4% month over month seasonally adjusted and 3% unadjusted year over year.

- Furniture and home furnishings stores were unchanged month over month seasonally adjusted but down 6.5% unadjusted year over year.

- Building materials and garden supply stores were down 0.2% month over month seasonally adjusted and 6.5% unadjusted year over year.

- Health and personal care stores were up 0.8% month over month seasonally adjusted and 7.3% unadjusted year over year.

- Electronics and appliance stores were down 0.8% month over month seasonally adjusted and 2.5% unadjusted year over year.

- Grocery and beverage stores were up 0.4% month over month seasonally adjusted and 2.1% unadjusted year over year.

- Sporting goods stores were unchanged month over month seasonally adjusted but down 1.6% unadjusted year over year.

- Clothing and clothing accessory stores were down 0.8% month over month seasonally adjusted but up 0.8% unadjusted year over year.

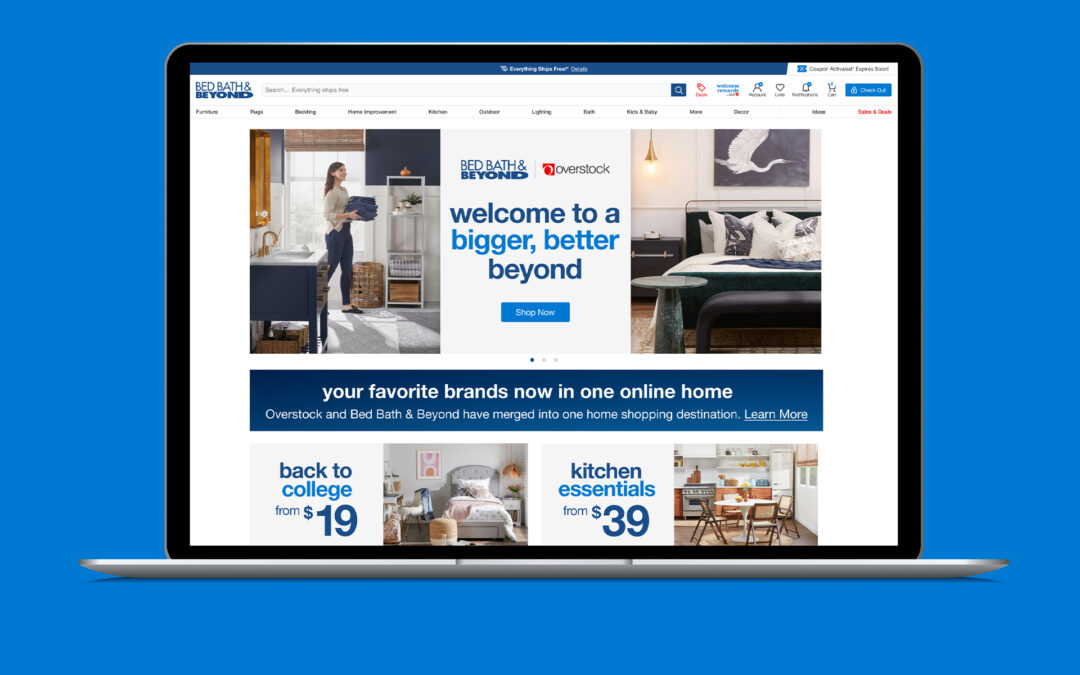

- Online and other non-store sales were up 1.1% month over month seasonally adjusted and 6.2% unadjusted year over year.

“September retail sales show that consumers have retained the ability and willingness to spend despite accumulating economic headwinds from higher interest rates and slowing growth,” NRF president and CEO Matthew Shay said in announcing the sales results. “As we gear up for the holiday season, we expect moderate growth to continue as consumers focus on value and household priorities. Retailers have been hard at work getting holiday inventories in place to provide consumers with great products, competitive prices and convenience at every opportunity.”

NRF chief economist Jack Kleinhenz added, “The consumer is still healthy, and today’s report shows households are forging ahead with plenty of buying power despite persistent inflation, rising interest rates and geopolitical conflicts. Firm payroll growth over the past few months has likely helped spending across retail sectors. However, much of the rise was due to car sales, gasoline prices and food services. When you exclude those categories and look at core retail as measured by NRF, the pace of year-over-year growth is slowing.”