Despite a slowing economy, retail sales rose in August as parents shopped for school supplies and other goods even as inflation continued and interest rates remained high, according to the National Retail Federation.

In citing figures from the United States Census Bureau, NRF stated that retail sales in August were up 0.6% from July and 2.5% year over year as compared to a gain of 0.5% month over month and 2.6% year over year in July.

NRF’s calculation of retail sales excludes automobile dealers, gasoline stations and restaurants to focus on core retail. In August, retail sales gained 0.1% seasonally adjusted from July and 3.3% unadjusted year over year as NRF calculates them. In July, core retail sales advanced 0.7% month over month and 3.3% year over year.

NRF’s retail sales were up 3.2% unadjusted year over year on a three-month moving average as of August and up 3.8% for the first eight months of 2023.

By channel, the results were:

- General merchandise stores up 0.3% month over month seasonally adjusted and 3% unadjusted year over year

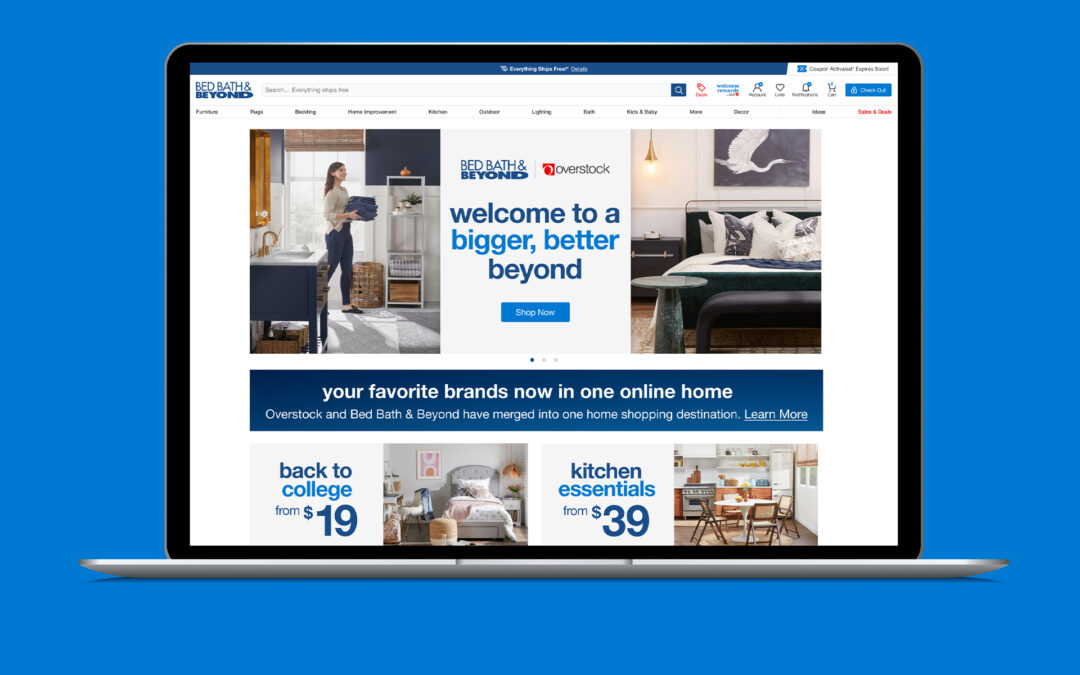

- Furniture and home furnishings stores down 1% month over month seasonally adjusted and 7.6% unadjusted year over year.

- Building materials and garden supply stores up 0.1% month over month seasonally adjusted but down 3.8% unadjusted year over year

- Health and personal care stores up 0.5% month over month seasonally adjusted and 7.8% unadjusted year over year

- Grocery and beverage stores up 0.4% month over month seasonally adjusted and 2.8% unadjusted year over year

- Electronics and appliance stores up 0.7% month over month seasonally adjusted but down 1.6% unadjusted year over year

- Sporting goods stores down 1.6% month over month seasonally adjusted and 1.6% unadjusted year over year

- Clothing and clothing accessory stores up 0.9% month over month seasonally adjusted and 3.6% unadjusted year over year

- Online and other non-store sales unchanged month over month seasonally adjusted but up 7.6% unadjusted year over year

“August retail sales show that consumers remain steadfast in the face of continued inflation and higher interest rates,” NRF president and CEO Matthew Shay said in announcing the sales numbers. “Consumers are focused on household priorities, as evident by spending this back-to-school season. Entering the fall, we expect moderate growth to continue despite uncertainties like the direction of inflation and interest rates as well as a potential government shutdown.”

NRF chief economist Jack Kleinhenz added, “NRF’s numbers show the pace of retail growth cooled from July but that even as they continue to be selective and price sensitive. Households have the capacity to spend, but momentum is slowing, in part because savings built up during the pandemic are running lower and credit costs are rising. Consumer spending growth has slowed, but there is little hint of any sudden collapse.”